Understanding Avalanche (avax) : A Comprehensive Overview

Explore the fundamentals of avalanches in this comprehensive overview. Learn about their causes, types, safety measures, and how to stay informed in mountainous regions.

Imagine a world where transactions are processed in less than a second, and decentralized applications (dApps) can scale to meet the demands of a growing user base. Welcome to Avalanche, the revolutionary open-source platform that's changing the face of blockchain technology. With its ability to process a whopping 4,500 transactions per second, Avalanche is leaving other blockchain networks in the dust.

What Makes Avalanche Tick?

At its core, Avalanche is a platform designed for launching decentralized finance (DeFi) applications and deploying enterprise blockchains. Its main token, AVAX, plays a crucial role in the ecosystem, serving as a rewards and payment system for users. But what really sets Avalanche apart is its unique consensus algorithm, which enables fast finality and high throughput without compromising decentralization.

Breaking Down Barriers

For too long, people have believed that Blockchains are slow and not scalable. Avalanche is here to challenge that misconception. By providing a new approach to consensus, the platform achieves strong security guarantees while maintaining decentralization. This means that individuals and institutions can easily create powerful, trusted, and secure applications and custom blockchain networks with complex rules, all tailored to their specific use cases.

The Purpose of Avalanche

So, what's the ultimate goal of Avalanche? Simply put, it's designed to address the shortcomings of existing blockchain networks, particularly Ethereum. By providing a new architecture and structure, Avalanche aims to process a large number of transactions in real-time, all while maintaining an acceptable level of decentralization. The platform seeks to create a global asset exchange environment where anyone can launch or trade any type of digital asset, controlling it in a decentralized manner using smart contracts and advanced technologies.

Avalanche in Numbers

Here are some impressive stats that demonstrate Avalanche's capabilities:

4,500 transactions per second Less than 1 second to confirm transactions Over 1,000 full nodes and block producers on the testnet Supports the entire Ethereum development toolkit

How does Avalanche work?

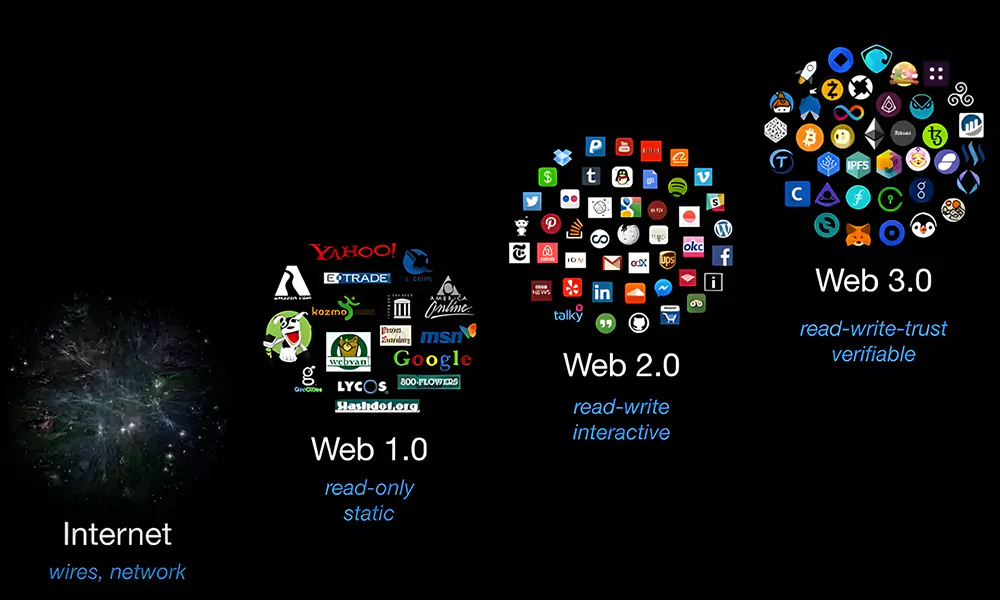

Imagine a decentralized network that's optimized for smart contracts and boasts a unique consensus protocol. Welcome to Avalanche, a game-changer in the world of blockchain technology! At its core, Avalanche uses a Directed Acyclic Graph (DAG) as its distributed ledger, which sets it apart from other decentralized networks.

DAG vs Blockchain: What's the Difference?

Avalanche's family of protocols operates on a principle of repeated voting based on partial patterns. Here's how it works: when a validator is unsure about a transaction, it reaches out to a small, random subset of validators for their opinion. These validators then respond with their verdict: accept or reject. If a validator thinks a transaction is invalid or has previously rejected it, they'll respond with a "reject" vote. Otherwise, they'll give it a thumbs up.

The Voting Process: How Avalanche Reaches Consensus

The validator takes a snapshot of the responses and uses a threshold, called alpha, to determine the outcome. If a large fraction of the sample validators agree that a transaction should be accepted, the validator will prefer to accept it as well. Conversely, if most validators think a transaction should be rejected, the validator will follow suit. This process is repeated until the alpha rate from the requested validators responds in the same way (accept or reject) for consecutive rounds, known as beta rounds.

The Magic of Avalanche: Fast Finalization and Conflict Resolution

In the normal case, where a transaction has no conflicts, finalization happens incredibly quickly. However, when conflicts arise, honest validators rapidly gather around the conflicting transactions and enter a positive feedback loop. This loop continues until all validators have given their opinion on the transaction. The result? Non-conflicting transactions are accepted, while conflicting ones are rejected.

Avalanche Ecosystem

Imagine a world where Blockchain technology is harnessed to create a decentralized platform for trading digital assets, coordinating validators, and enabling the creation of new subnets. Welcome to the Avalanche Platform, a revolutionary ecosystem that's changing the game. At its core, Avalanche has three internal blockchains that work together in harmony to provide a seamless experience.

Meet the Trio: Exchange Chain, Platform Chain, and Contract Chain

Exchange Chain (X-Chain): This is where the magic happens. The X-Chain is a simple payment chain that allows users to create and trade digital assets with ease. Powered by the Avalanche Virtual Machine (AVM), it provides a decentralized platform for asset creation and trading. With X-Chain APIs, users can create and trade assets on the chain, opening up a world of possibilities.

Platform Chain (P-Chain): This metadata blockchain is the backbone of Avalanche, coordinating validators, monitoring active subnets, and enabling the creation of new subnets. The P-Chain uses the Snowman consensus protocol, ensuring the integrity of the network. With P-Chain APIs, users can create subnets, add validators, and even create new blockchains.

Contract Chain (C-Chain): This is where smart contracts come to life. The C-Chain is compatible with the Ethereum Virtual Machine (EVM), allowing developers to create and deploy smart contracts with ease. With C-Chain APIs, the possibilities are endless, from decentralized applications to custom tokenomics.

The Primary Network: The Guardian of Avalanche

All three blockchains are validated and secured by the Primary Network, a special subnet that ensures the integrity of the ecosystem. To join the Primary Network, validators must stake at least 2000 AVAX, demonstrating their commitment to the network. But what does staking mean in the world of cryptocurrencies?

Staking 101

Staking is the process of holding a certain amount of cryptocurrency in a wallet or on a exchange to support the validation of transactions on a blockchain network. In the context of Avalanche, staking is required to join the Primary Network and participate in the validation process. By staking AVAX, validators demonstrate their skin in the game, ensuring the security and integrity of the network.

Subnets: The Building Blocks of Avalanche

A subnet, or subnetwork, is a dynamic collection of validators that work together to reach consensus on the state of a set of blockchains. Avalanche subnets have some amazing features, including:

Application-specific subnet creation Private or public subnet creation Custom tokenomics

These features allow developers to create customized subnets that meet their specific needs, opening up a world of possibilities for decentralized applications and use cases.

Meet the Founders : Ava Labs is the mastermind behind the Avalanche project, and it's led by three brilliant founders: Emin Gün Sirer, Kevin Sekniqi, and Maofan Ted Yin. Emin, a renowned computer scientist, has been a significant player in the Bitcoin network, focusing on scalability.

His research ultimately led to the development of Avalanche's innovative consensus mechanism, which enables the platform to process transactions at a much higher volume than Bitcoin, giving payment giants like Visa a run for their money!

The other two founders, Kevin and Maofan, are also affiliated with Cornell University, where Emin serves as an advisor to Maofan, who holds a PhD in computer science. The rest of the team consists of experts from various fields, including computer science, economics, finance, and law.

Roadmap Review : Having a clear roadmap is essential for any project, and Avalanche is no exception. Although we couldn't find a specific roadmap for 2022, we did come across their 2021 roadmap, which was published on Medium. Last year, the team focused on several key tasks, including:

Enhancing the Avalanche Wallet user experience Building a blockchain bridge between Avalanche and Ethereum Introducing dynamic fees for the C-chain Implementing governance for the P-chain Developing and expanding liquidity and the ecosystem as a whole

Investors and Partnerships: Avalanche has attracted an impressive array of investors, with nearly $300 million in funding across various rounds. Some of the notable investors include:

AU21 Capital Andreessen Horowitz Bitmain Technologies Digital Asset Capital Management Three Arrows Capital Polychain Capital NGC Ventures Galaxy Digital Dragonfly Capital HashKey

The project has also collaborated with several prominent partners, such as Mastercard, Liminal, Shopping.io, and Deloitte. These partnerships demonstrate the growing interest and support for the Avalanche ecosystem.

AVAX Tokenomics

At the heart of the Avalanche platform lies the native cryptocurrency, AVAX. This powerful token plays a vital role in securing the network through staking, covering fees, and acting as a fundamental unit of exchange between subnets created on the platform. But what's really interesting is that the total supply of AVAX is capped at 720 million, with 360 million already in circulation at launch and another 360 million set aside for staking rewards to be released over the coming years.

Let's take a closer look at how AVAX is distributed:

50% is reserved for staking rewards,

encouraging users to participate in securing the network 2.5% was allocated to Seed stage sales,

providing early support for the project 3.5% went to private sales,

allowing key partners to get involved 9.97% was sold through various public sales,

giving the community a chance to join in 9.26% is held by the foundation,

ensuring the long-term sustainability of the project 7% is dedicated to the community and developers,

fostering growth and innovation 0.27% was awarded to participants in the Testnet Incentive Program,

recognizing their contributions 5% is allocated to strategic partners,

strengthening relationships and driving adoption 2.5% was airdropped to AVAX enthusiasts,spreading the love And finally,

10% is reserved for the team, acknowledging their hard work and dedication

As of the latest update from Mihan Blockchain, approximately 282 million AVAX out of the total 406 million are currently in circulation. The price of AVAX stands at $20.17, with a market capitalization ranking of 15th among all cryptocurrencies. The total market value of AVAX is an impressive $5.7 billion, with a 24-hour trading volume of around $390 million. The token has experienced significant price fluctuations, ranging from a low of $2.80 on January 1, 2020, to a high of $144.96 on November 2, 2020.

Conclusion

Avalanche is a game-changer in the world of smart contracts and decentralized application development, focusing on scalability like never before. With the ability to process a massive number of transactions in real-time, confirming each one in under 1 second, it's no wonder this platform is turning heads. The trio of chains - X-Chain, P-Chain, and C-Chain - along with subnets, provide developers with a unique set of features and APIs that set Avalanche apart.

But what really makes Avalanche stand out is its use of a Directed Acyclic Graph (DAG) instead of a traditional blockchain, paired with a one-of-a-kind consensus algorithm. This combo allows for unprecedented speed and efficiency. As we explored in this article, the team behind Avalanche, its investors, roadmap, and native coin, AVAX, all contribute to its impressive reputation.

So, can Avalanche maintain its top spot? With its cutting-edge tech, dedication to scalability, and growing ecosystem, it's definitely a strong contender. As the crypto landscape continues to evolve, it'll be exciting to see how Avalanche adapts and innovates to stay ahead of the curve. What are your thoughts on Avalanche? Do you think it has what it takes to remain a leading project in the crypto space?

Source: avaxholic.com

Related News

Add a Comment

Please login to your account to post a comment.

Popular News

A Golden year for gold Could Bitcoin reach new price highs following gold lead?

2024-09-27 07:39:00

Meta $4.5 billion loss in the last 3 months. Metaverse bubble destruction domino activated?

2024-08-02 13:44:00

Important tips for the successful entry of inexperienced people into digital currencies

2024-03-14 10:32:00

TonKeeper Wallet Tutorial

sunswap review

comprehensive coinbase exchange review

cryptoeconomie is an independent media outlet covering the cryptocurrency industry. Its journalists adhere to a strict set of editorial policies. cryptoeconomie has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. cryptoeconomie provides essential analysis of the cryptocurrency market. Our goal is to inform, educate and share valuable information with our readers. Our editorial content is based on our passion for providing unbiased news, in-depth analysis, comprehensive cryptocurrency price charts, insightful opinions, as well as regular reporting on the social transformation that cryptocurrencies are bringing. We believe that the world of blockchain and cryptocurrencies will grow exponentially and become an integral part of our daily lives. We work every day to help educate our readers and raise awareness of the complexities and benefits offered by today’s digital revolution.

Categories

© Copyright 2025 cryptoeconomie.com . Design by: uiCookies

Comments