Tether,s Comeback: Launching a New USD-Backed Stablecoin

Tether, the largest issuer of various stablecoins in the world, plans to launch a new stablecoin pegged to the US dollar. Stay tuned to see what advantages and differences this new token has over USDT.

Tether, the world's largest stablecoin issuer, is making a significant move to re-enter the U.S. market with a new USD-backed stablecoin by the end of this year. This strategic step, as reported by CNBC, reflects Tether's efforts to enhance its reputation in the U.S. and strengthen collaboration with regulatory and law enforcement agencies.

Why This Move Matters

Strengthening Credibility: Tether CEO Paolo Ardoino highlighted the company's robust reserves, including approximately $120 billion in U.S. Treasury bonds, calling them "unprecedented." This emphasizes Tether's commitment to transparency and stability in the crypto space.

Policy Influence: The move is part of Tether's broader strategy to shape cryptocurrency-related policies in Washington, signaling its intention to be a key player in the evolving regulatory landscape.

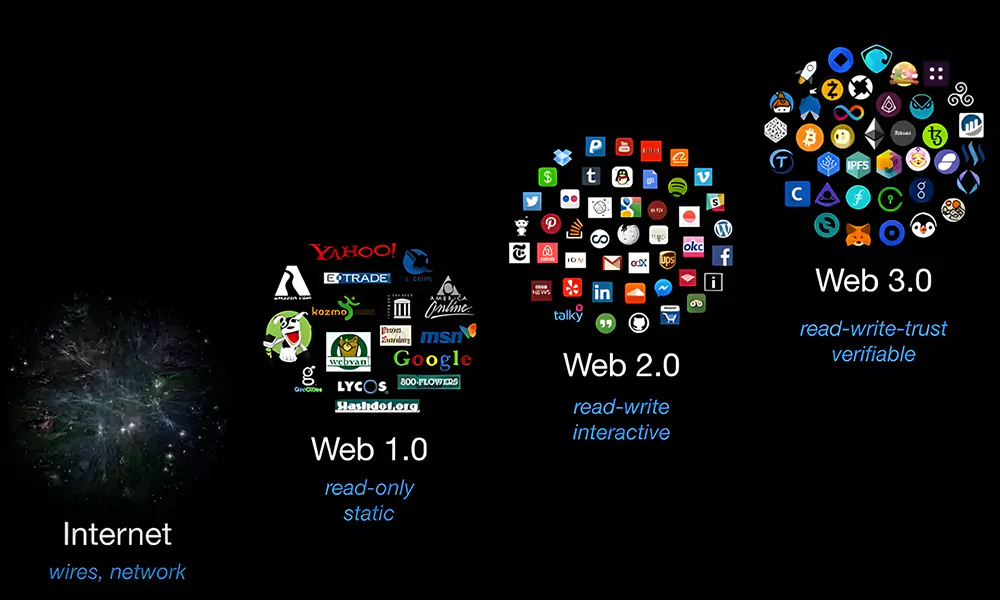

Tether, founded in 2014, is a pioneer in the stablecoin market. Stablecoins are cryptocurrencies pegged to the value of a traditional currency, such as the U.S. dollar, to reduce volatility.

What is Tether?

Tether is the largest issuer of stablecoins, with its most popular product being USDT (Tether), which is pegged 1:1 to the U.S. dollar. USDT is widely used in cryptocurrency trading, payments, and decentralized finance (DeFi).

Tether's Products

USDT (Tether): Pegged to the U.S. dollar and the most widely traded stablecoin. EURT: Pegged to the Euro. GBP Tether: Pegged to the British Pound. JPY Tether: Pegged to the Japanese Yen. XAUT(Tether Gold): Pegged to ounces of gold.Why Tether Matters

Liquidity and Stability: Tether provides a stable store of value and facilitates smooth transactions in the volatile crypto market. Regulatory Focus: Tether has faced scrutiny in the past, but its efforts to improve transparency and comply with regulations underscore its commitment to legitimacy.Tether's Holdings

Tether's reserves, including significant holdings in U.S. Treasury bonds, demonstrate its financial strength. These reserves are crucial for maintaining the stability of its stablecoins.

Related News

Add a Comment

Please login to your account to post a comment.

Popular News

A Golden year for gold Could Bitcoin reach new price highs following gold lead?

2024-09-27 07:39:00

Meta $4.5 billion loss in the last 3 months. Metaverse bubble destruction domino activated?

2024-08-02 13:44:00

Important tips for the successful entry of inexperienced people into digital currencies

2024-03-14 10:32:00

TonKeeper Wallet Tutorial

sunswap review

comprehensive coinbase exchange review

cryptoeconomie is an independent media outlet covering the cryptocurrency industry. Its journalists adhere to a strict set of editorial policies. cryptoeconomie has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. cryptoeconomie provides essential analysis of the cryptocurrency market. Our goal is to inform, educate and share valuable information with our readers. Our editorial content is based on our passion for providing unbiased news, in-depth analysis, comprehensive cryptocurrency price charts, insightful opinions, as well as regular reporting on the social transformation that cryptocurrencies are bringing. We believe that the world of blockchain and cryptocurrencies will grow exponentially and become an integral part of our daily lives. We work every day to help educate our readers and raise awareness of the complexities and benefits offered by today’s digital revolution.

Categories

© Copyright 2025 cryptoeconomie.com . Design by: uiCookies

Comments